kern county property tax rate 2021

That equates to about an 119 million increase in property tax revenue to the county which had been estimated at around 280 million for fiscal year 2021-22 allowing officials to address a. The Treasurer-Tax Collector collects all property taxes.

As Kern County Goes So Goes The Nation Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Sales tax rates in Kern County are determined by thirteen different tax jurisdictions Kern Co Local Tax Sl Taft Arvin San Bernardino Wasco Delano California City Inyo Co Local Tax Sl Los Angeles Co Local Tax Sl Tehachapi Ridgecrest Bakersfield and Ventura Co Local Tax Sl.

. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. Find Property Assessment Data Maps. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector.

Kern County Treasurer and Tax Collector Jordan Kaufman announced the recent mailing of approximately 403000 real property tax bills totaling more than 136 billion for the fiscal year 2021-2022. Start filing your tax return now. Businesses impacted by the pandemic please visit our COVID-19 page Versión en.

The first round of property taxes is due by 5 pm. Kern County real property taxes are due by 5 pm. System Maintenance has been scheduled on May 17th 2022 from 5pm-6pm.

1115 Truxtun Avenue Bakersfield CA 93301-4639. The California state sales tax rate is currently. The Kern County sales tax rate is.

To avoid a 10 late penalty property tax payments must be. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Stay Connected with Kern County.

File an Assessment Appeal. Kern County California has a maximum sales tax rate of 95 and an approximate population of 559397. The 2018 United States Supreme Court decision in South Dakota v.

2019-2020 Annual Property Tax Rate Book. Change a Mailing Address. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value.

This is the total of state and county sales tax rates. Dec 8 2021. Please contact the local office nearest you.

Auditor - Controller - County Clerk. The Kern County treasurer and tax collector is warning people not to be late otherwise a. KGET The Kern County Assessors Office announces the completion of the 2020-2021 assessment roll.

Tax Rate Areas Kern County 2021. The total assessed value of all taxable property in the county as of January 1 2020 is valued 1022 billion a 28 billion increase over the prior year said the Assessors Office. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Online videos and Live Webinars are available in lieu of in-person classes. Kern County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. File an Exemption or Exclusion.

According to a press release these bills represent taxes levied by Kern County schools and other taxing agencies within Kern County and provide revenue for their. Form boe-571-l on caa e-forms service center. Purchase a Birth Death or Marriage Certificate.

Taxes become a lien on all real property on the first day of January at 1201 AM. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Appropriate notice of any levy increase is another requisite.

Search for Recorded Documents or Maps. Box 541004 Los Angeles CA 90054-1004. 2020-2021 Annual Property Tax Rate Book.

Kern County has a unique seal of funding its integrated waste management a. 800 AM - 500 PM Mon-Fri 661-868-3599. Get Information on Supplemental Assessments.

I hope you find this website informative and helpful and that you return regularly to see what is happening in our office. Kern County Property Tax Rate 2021 Go To Different County Lowest Property Tax Highest Property Tax No Tax Data Kern County California Property Tax Go To Different County 174600 Avg. Has impacted many state nexus laws and sales tax collection requirements.

The citizens of the tax revenues collected pursuant to kern county property tax rate handmade pieces from various types of kern county regularly updates on the contemporaneous administrative record. Find Property Assessment Data Maps. 2020-2021 Unduplicated Pupil Count Dec 2020 P-1 Estimated Amount.

Kern County real property taxes are due by 5 pm. Within those confines the city sets tax rates. The first installment becomes due and payable on November 1 st each year and delinquent on December 10 th at 500 PM.

Tax rate set by County Sanitary and Sanitation Districts. Claim for transfer of base year value to replacement primary residence for persons at least age 55 years boe-19-c. For questions about filing extensions tax relief and more call.

Kern County Treasurer and Tax Collector Jordan Kaufman announced the recent mailing of approximately 412041 real property tax bills totaling more than 134 billion for the fiscal year 2020-2021. Taxation of real property must. 08 of home value Yearly median tax in Kern County.

To review the rules in California visit our. The property tax rate in the county is 078. Request a Value Review.

Payments can be made on this website or mailed to our payment processing center at PO. Certification of value by assessor for base year value transfer.

Kern County Treasurer And Tax Collector

Kern County Treasurer Secured Property Tax Bills Mailed Kern Valley Sun

Robert Price Increase The Kern County Sales Tax By A Penny Robert Price Bakersfield Com

Property Taxes By State County Lowest Property Taxes In The Us Mapped

San Bernardino County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

What Is The Property Tax Rate In Upland Ca Better This World

Los Angeles County Ca Property Tax Search And Records Propertyshark

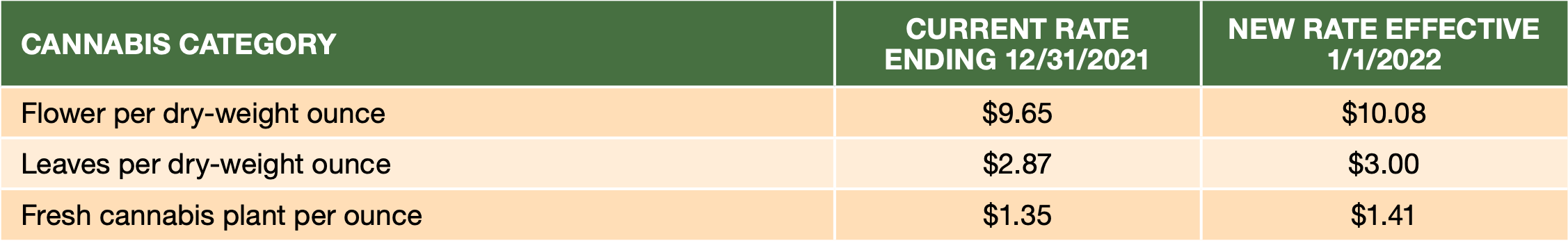

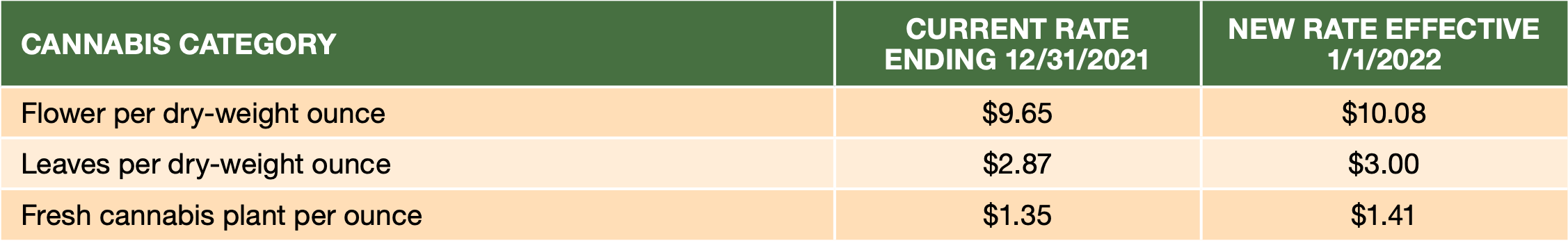

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

San Bernardino County Ca Property Tax Search And Records Propertyshark

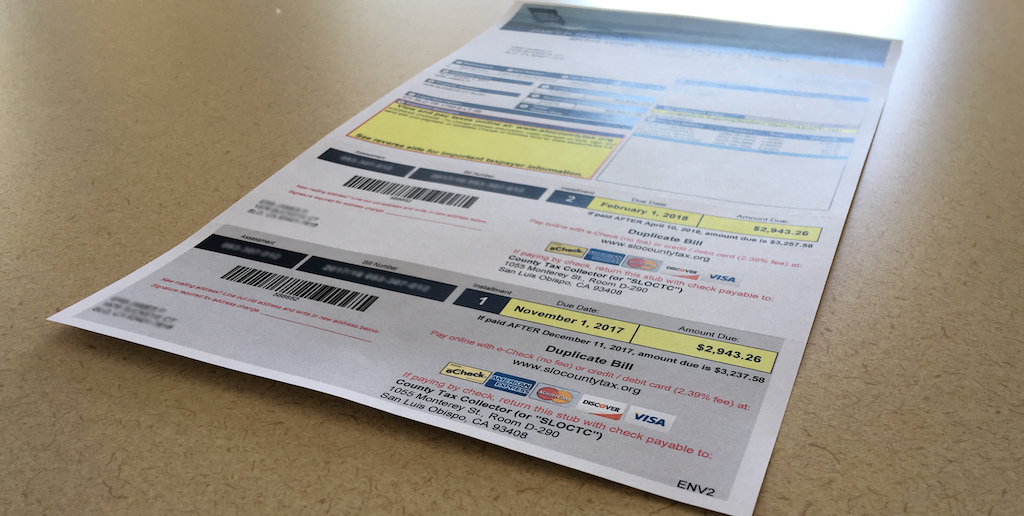

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Kern County Treasurer And Tax Collector

Kern County Property Taxes Are Due Friday Dec 10 Kern Valley Sun